In order to bring the methodology of “benchmark” indicators for the money market interest rates and the operational mechanism of monetary policy in line with international standards, the Central Bank, with the support of International financial institutions and consulting agencies, on an ongoing basis analyzes and makes proposals.

Based on the experience of advanced foreign countries that have switched to the inflation targeting regime and international financial markets, in order to develop the operational mechanism of monetary policy and increase the importance of money market indicators:

from August 4, 2022, the duration of the main operations aimed at regulating liquidity - deposit auctions will be reduced by 1 week and will be held once a week;

the role of 1-week deposit auctions in the regulation of overall liquidity will be increased in order to effectively transfer the decisions of the Central Bank on the change of the policy rate to the money market;

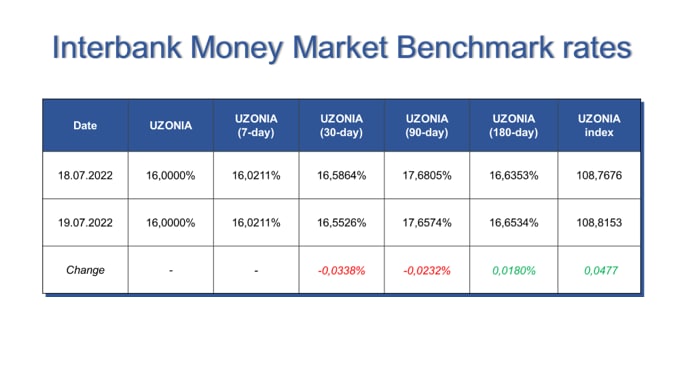

from July 22, 2022, the "UZONIA" interest rate, which represents the short-term resource price, the "UZONIA" index and the compounded "UZONIA" interest rates for different periods will be calculated and announced (in accordance with Appendix 1).

For information: "Methodology for calculating and announcing the UZONIA index (Uzbek Overnight Index Average) of the Interbank Money Market of the Republic of Uzbekistan" was developed with the participation of the European Bank for Reconstruction and Development and all commercial banks and was approved at the meeting of the Central Bank Board on July 21, 2022.

Appendix - 1

“UZONIA” interest rates and “UZONIA” index

on interbank money market operations

Appendix - 2

Operational mechanism of the Central Bank*

|

Goal |

Tools |

Conditions |

Interest rate |

Task |

|

Liquidity provision operations |

1-week REPO auctions |

On 7 days |

Policy rate |

Provision of temporary shortage of liquidity in the banking system |

|

1-week SWAP auctions |

On 7 days |

|||

|

2-6 days “fine tuning” REPO and SWAP auctions |

On demand |

|||

|

Overnight REPO |

For 1 day |

Policy rate |

Provision of the daily liquidity shortage in the banking system |

|

|

Overnight SWAP |

||||

|

Liquidity absorbing operations |

Overnight deposit operations |

Overnight |

Policy rate |

Absorbing daily excess of liquidity in the banking system |

|

1-week deposit auctions |

On 7 days |

Policy rate |

Absorbing temporary excess of liquidity in the banking system |

|

|

2-6 days “fine tuning” deposit auctions |

On demand |

|||

|

Central bank’s bonds |

Up to 12 months

(schedule based) |

Policy rate |

Absorbing structural excess of liquidity in the banking system |

* The changes are marked by red color