Based on the experience of advanced foreign countries and international financial markets that have transited to the inflation targeting regime, the following changes will be introduced from February 20, 2024, in order to develop the operational framework of monetary policy and increase the efficiency of liquidity management in commercial banks:

1. Based on the overall liquidity condition in the banking system, the practice of holding 1-week REPO auctions will be introduced to provide liquidity to banks.

REPO auctions are held on Mondays at 11:00 a.m. and serve to provide liquidity to commercial banks during the week. These auctions are carried out at a variable interest rate (minimum – policy rate) in a fixed amount based on the banking system's liquidity forecast.

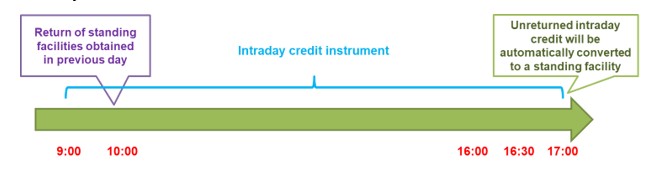

2. Intraday credit instrument of the Central Bank for providing liquidity to commercial banks – interest-free credit operations will be introduced until the closure of the bank payments with clients. The main purpose of using this instrument is to ensure the continuity of payments in the banking system and to provide banks with the necessary liquidity during the day.

It is envisaged that the banks will use the funds attracted through this instrument during the day and return them by the end of the client payments. Intraday loan instruments that are not repaid before the closure of bank settlement day are automatically converted into interest-bearing overnight operations.

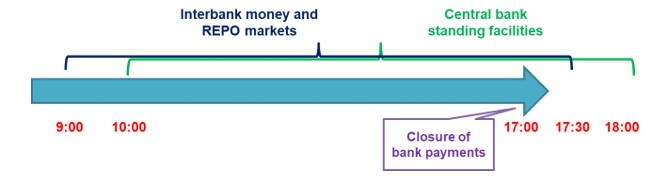

3. The operating hours of interbank money and REPO markets will be extended until 30 minutes after the closure of bank payments with clients as well as banks will be able to use the overnight operations of the Central Bank within 1 hour after the closure of the bank payments.

As a result of this change, after the completion of payment operations with the clients of commercial banks, there will be an opportunity to redistribute liquidity among themselves and then apply to the operations of the Central Bank. In this case, the activity of banks in the interbank money and REPO markets is expected to increase further.

4. In order to minimize the credit risk in the implementation of monetary operations, a 5 percent haircut will be applied to collateral property for liquidity providing operations.

Improvements mentioned above will provide more flexibility and convenience to commercial banks in liquidity management, ensure the continuity of the payment system, and minimize the credit risk of monetary operations.